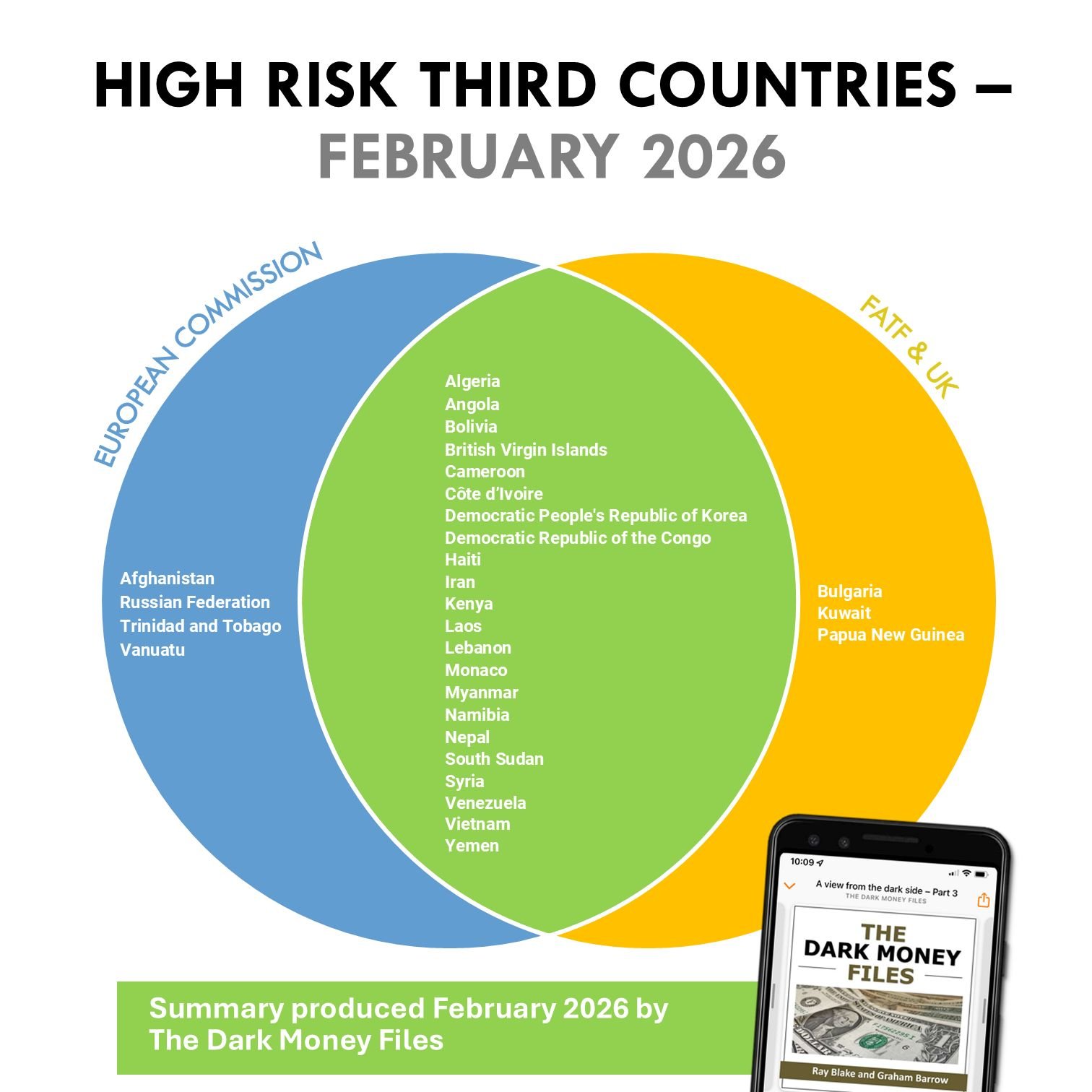

High Risk Third Countries

High Risk Third Countries can be a confusing area, and exists alongside, not instead of Firm’s own risk assessments.

High-risk and other monitored jurisdictions

In August, HMRC reminded supervised entities that Turkey and Jamaica had been removed from the grey list in June. However, they neglected to mention that Monaco and Venezuela had been added—or “recognised” in the wording of FATF.

AML 4 MSB 11. More SARS

As a general rule -

Money Service Businesses are viewed as high risk. Money Service Businesses do not do enough SAR. When in doubt - report.

AML 4 MSB 10. Suspicious Activity

Anyone in the business who feels something is off should report that to the Nominated Officer. I firmly recommend that these internal reports should NOT be called SAR. (I’ll explain later). Staff should be encouraged to report whenever they feel the slightest bit suspicious.

PEP Talk

In practical terms - PEP detection needs to be part of your risk-based approach. You might for example ask the question over a certain limit, or if the transaction is unusual in another way.

If your business is presented with a PEP, you must conduct Enhanced Due Diligence. Essentially, you need to satisfy yourself that the person in front of you is not attempting to transact with the proceeds of abuse of a public office.

Get in touch.

Questions? Drop us a line. If we can help, we will.